AAPL Daily

A drop below the Daily threshold that stays below the threshold into the close will constitute a Daily SELL Signal. I'll send out a special alert if we get a preliminary signal during the day. Look at the previous five signals on the chart, all nice winners.

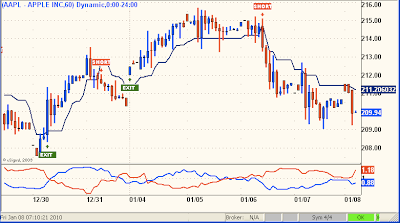

For some perspective, note how the Hourly Model is already SHORT:

AAPL Hourly

18 comments:

Allan,

We might try to filter the hourly ATR signal with your Vortex oscillator. Expanding on your idea using the 4 period RSI, I propose that we take signals in the direction of the Vortex trend, ignoring those signals that generate without confirmation from the Vortex indicator.

We could take the first signal on the chart LONG. The following signal is SHORT, but without a Vortex crossover, we could ignore it and stay long.

Vortex indicator changes to SHORT, followed by a SHORT ATR signal. This is where we can sell the LONG position established on 12/30 and initiate a successful SHORT position on 1/6.

What do you think? Would it be worth it to apply this filter to the SPY, SDS, and TZA hourly model? It might cut down on some whipsaws.

Jeff - Excellent idea and observation, will take a closer look over coming weekend, for now, lets monitor until i get the chance to do a complete backtest.

Allan: If I subscribe for a year can I "lock in " an annual rate of 8-10K?

Rick

Rick, You can't subscribe for a year, but you can lock in the $50/mo rate if you subscribe before end of January.

(Why no annual subscriptions? Once NNVC hits $100, my work is done.)

A

Allan...I think I understand the hourly...If the pivot is LONG TZA @ X...it MUST close @ or above that pivot @ 10..11..12PM and so on? What do you like to play if it is 12:45 PM and the pivot is hit?...will you wait for the close on the hour and see if hold or is higher..or would you go early?

Taz

Take an initial position upon breaking the threshold and then complete the position upon hourly confirmation.

Thank you Sir...SRS was a nice call yesterday...holding up well...

Taz

Wow Allan you are a total hottie....new pic I'm digging it.

Jeff said:

"We might try to filter the hourly ATR signal with your Vortex oscillator. Expanding on your idea using the 4 period RSI, I propose that we take signals in the direction of the Vortex trend, ignoring those signals that generate without confirmation from the Vortex indicator."

Ok, so...where does your average, every day, buy and hold investor learn this stuff. I want to participate but much of what I read sails over my head.

Anybody in the Los Angeles area want to teach a mini class for a small fee and perhaps lunch...and beer?

-Steve in L.A.

Steve,

Here's the thing.

Allan's hourly models are designed for non-emotional, mechanical simplicity.

For example, if the price of XYZ closes a time period above the ATR line, we enter/exit a position. If the price closes below the line, we reverse. We take each signal as they come, to maintain consistency and a non-emotional state of mind.

As Allan will openly admit, taking each signal will lead to nearly as many losing trades as winners. Though the winners should, over time, outweigh losers, they reduce the efficiency of the trading model.

A "filter" would change the way we trade the model. Instead of taking each signal, we selectively choose the signals based on another piece of criteria. The idea is to reduce whipsaws and stay in winning trades for a longer time period. For an hourly chart, this is ideal because it might mean only trading a few times a week. This is good for people like me who cannot day trade due to account restrictions. Still, we can stay in a solid position for a few days or a week or more at a time.

Allan mentioned another filtering technique, using the weekly ATR signals to offer direction and daily signals to give us timing. The daily chart of GOOG the other day was a prime example. Taking daily signals in the direction of weekly signals, over the course of 2009, would have netted a small fortune to any novice trader. And it would have only required a trade every other month or so.

I didn't mean to confuse you with the Vortex idea. I just noticed that Allan had started to incorporate it into his recent charts, and eyeballing AAPL's hourly chart showed its promise as a filter.

Hopefully Monday will be a high. http://2.bp.blogspot.com/_JtCCqf6A1qg/S0USNuck_4I/AAAAAAAAAOk/B_EDPeqRjTg/s1600-h/tides+1-6-10.jpg

curt

Hey Jeff,

Thank you mucho for the detailed response. The idea of adding an additional filter which hopefully will create a higher percentage of winners and ALSO result in less trading sounds great.

However, this stuff is still so damn esoteric. Well, at least it is for me right now. I can't help but feel like I'm stepping into shark infested waters with a cut on my leg and a booger hanging out my nose...

-Steve in L.A.

Another try: http://tidallyspeaking.blogspot.com/

1/11 high, 1/15 low. But this low volume is allowing retail to buy up the market. Very view CME pit locals to sell spoos these past weeks and the prop desks at the big banks have been quiet. JPM just bot 200 spoos jumping the market almost 5 pts. That's normally not possible.

curt

Steve,

Take it slow...

The market isn't going anywhere.

-Mike<greeting from snowed in NY

Allan, is the breakout of NNVC,still in place?

Average P/E On The S&P 500 is 29.90, But Only 365 Companies Count

The average S&P500 P/E ratio now stands at 29.90, as measured by Google Finance. This excludes all those companies with negative earnings.

At the end of October, this average was 36.60 and there were 375 companies with positive P/Es. Today there are 10 fewer, 165, so please take this into account!

The number of companies keeps getting smaller ever since we started tracking them about a year ago. On April 16 2009, the average P/E was 16.20, and the number of companies was 399.

source: shockedinvestor.blogspot.com

Rossington Collins Band - Opportunity

My own thoughts about nnvc based on analyzing the chart is that a fair pullback is now in order in the next week or two....likely to the .89 area. a stronger drop would return to.84 and .80 and IF Holding at these levels into february would be positive....but the greater market is so due for a major correction at this time ,its hard to tell how it would affect NNVC and any pullback off the new high.

The timing might coincide;

which could spell a bit of trouble for the normal support levels.

The key s/r points for NNVC

are 1.00/.89/.80/.70/and the .54 area

If the market wasnt rolling around at the top like it is,and this NNVC breakout could move forward in normal ways,I would expect a solid support at .89 or .84 to hold,and become the 'last chance to buy under a dollar'

But given the market needing a major correction, it wouldnt surprize me to see a drop to .70 by the time the correction finishes in a few months time.

But wherever it bottoms,I will buy more.

I'm not an expert on NNVC so I certainly cant speak for Allan.

I just study the chart.and the market.

NNVC ... buy & hold until 2014 or a buyout before then.

Alas! It is written: "More is ok, fewer is not."

So, Watson, one does not trade out of the 10,000 share elementary position.

The Big Rock Candy Mountain

Post a Comment