Renko

Bar

Mystery Chart

I'm curious to see how long it takes one of my readers to identify this third, "Mystery" chart. I'll reserve my comments for now, hoping to generate a discussion of what everyone sees in these charts, in these signals.

A

Now getting back in theme in this Bear Cave, although I use the SPX as a proxy to the market i am interested that this DOW Renko chart went on sell for the first time since the March low:An astute observation by Lasertrader, Allan is drawn to mechanical systems, objective rule-based strategies and maybe something Lasertrader didn't know, Allan reads and considers every Comment to his posts, whether or not he responds to it (publicly or privately) or not.

http://stockcharts.com/h-sc/ui?s=$INDU&p=D&st=2008-12-15&id=p29271801842&a=171181543

and I know how Allan likes mechanical system..check out this GDX Gold Miner 60 minute Renko chart. It went long a couple of days ago and has been an extremely good mechanical trade

http://premium.fileden.com/premium/2006/9/9/209573/gdxrenko2306.png"

"That's last night. Over 12,000 contracts traded in two five-minute periods, over 10,000 right up on the time of that spike. There was no news of any sort related to the US markets on the wire last night. Zero. None. I and many others were wondering what the heck caused that. This morning, the buying began in earnest at 8:30 Central, and then again at 10:00 Eastern - one hour in front of the "announcement", again on heavy volume. Where is the SEC?

"Where is the SEC's demand for trading records on these contracts, particularly the ones last night on Globex? That was a highly unusual trading pattern that strongly suggested that someone knew something and acted on it front of a news release. Well, now we have the news release. It sure wasn't the (bad) unemployment or (neutral) GDP numbers. So what's left?"

What's in a name? that which we call a rose By any other name would smell as sweet; So Romeo would, were he not Romeo call'd, Retain that dear perfection which he owes Without that title. Romeo, doff thy name, And for that name which is no part of thee Take all myself.

---Juliet

Experience is never limited, and it is never complete; it is an immense sensibility, a kind of huge spider-web of the finest silken threads suspended in the chamber of consciousness, and catching every air-borne particle in its tissue.

Henry James

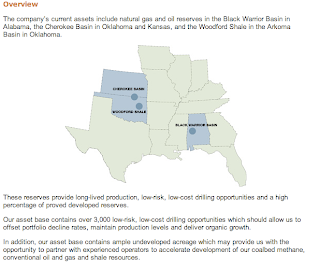

"These reserves provide long-lived production, low risk, low-cost drilling opportunities and a high percentage of proved developed reserves."