If all answers were obvious, our brains would have no use for reason.

Lets start with the charts.

First up is the Triangle chart, a quick and dirty way of assessing technicals. We see a +100 score accompanied by both weekly and monthly bullish triangles. This is enough information to make a nice living off of the stock market. But the explanation underlying that statement is being saved for a future blog, all to it's own. For now, suffice it to say thumbs up; way, way up.

Above is the Blue Wave weekly chart, providing the most conservative view of potential. Here, a Wave 4 advance is shown, targeting a move to $10-15. With CEP trading at $4.57, even if the 90% downtrend is still in effect, the stock has potential to double or triple from current prices.

I'm posting the above daily chart, a time period that you seldom see me post. Why not? Because everyone is looking at the dailies, I like looking from more unique perspectives. But the daily chart does provide an important piece of the puzzle, a stop. Blue Wave will turn bearish on this chart at the level of $3.81. Thus we have a risk:reward perspective. The risk is about $0.50, or about 12%. Earlier it was suggested that a 100%-200% gain was being targeted. So the play here is to risk about 12% to gain between 100%-200%. I'll take that bet.

Let's drill down to the 120 minute CEP chart:

Some added information shows an Elliott Wave 3rd Wave, confirmed by the Elliott Oscillator. All the EO is suggesting is that since it is making new highs along with share prices, that the current rally (Wave 3) is stronger then it's predecessor (Wave 1) as should be the case is if the shown 3rd Wave is being accurately counted. We would expect a non-confirmation to accompany the next bullish wave up (Wave 5), so again, the likelihood is that this isolated upmove is not a terminal wave and will be followed by a weaker advance, sometime into the future. It is those non-confirmation advances that have us looking out for an ABC decline of significance and none can be assumed imminent from the above chart.

Now the bad news.

CEP is a Limited Liability Company and thus it's income/expense items are passed through to owners/shareholders. It also means that it's hefty dividend yield is part income, part return of capital. Not much of a problem for stock held in retirement accounts, but added confusion when it comes time to file income taxes for non-retirement accounts. Personally, I ignore such issues when it comes time to buy something that has a 12% risk against a 100%-200% gain. But to each his or her own.

Fundamentally, the company looks pretty damn good as long as natural gas continues to rise, or even holds firm, or even eases somewhat from current levels. If natural gas takes the pipe, i.e. a significant haircut from current pricing, the payout may be threatened.

CEP was a $50 stock in August of 2007. They arguably have a better array of properties and natural gas reserves both proven and unproven today. Like other MLP's (Master Limited Partnerships) their shares price to pay-outs and are aligned with junk bond status securities which make them somewhat sensitive to the direction of interest rates.

But then there is this:

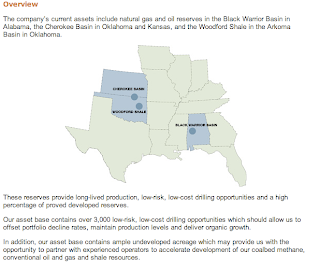

"These reserves provide long-lived production, low risk, low-cost drilling opportunities and a high percentage of proved developed reserves."

The cross-bar. Zetterberg's third period shot hit the cross-bar, bounced to the ice and skipped harmlessly away from the Penguin goal............and we knew, it was over.

The agony of a game of inches, where reason and right, collide against cold hard steel, then dance inexplicably into the abyss.

A

22 comments:

"But the explanation underlying that statement is being saved for a future blog, all to it's own"

Glad to see you're not experiencing severe withdrawal symptoms.

-Mike

Nice pick Allan, thanks

Something else, the last spike of NNVC at $1.29 few time ago, I made no action due to marriage correlation with this specific stock.

Now, with the current spike of LWLG i'm confused again.

Got any scenario/technicals for LWLG or should i marry this one too?

Serge

Pens are a better team, pure and simple, and they proved it. Wings couldnt win a game 7 of the Stanley Cup finals on their own home ice. And with the Pens captain and arguably the best talent in the NHL watching from the bench. That says it all. There should have many other golden opportunities beyone that one crossbar for a team you laud so heavily. Sorry Alan, but the Wings days are over. Just like this "bear" market is over.

With the entire world looking for this upcoming decline into oblivion, the unanticipated and unabated advance higher is going to shock everyone of them.

Huge hangover still lingers from last night, hockey is more a cult than a sport and its' followers can easily drink all the kool aid and everything else behind a well stocked bar. Amazing how quickly things got so way out of control. Wow, too much fun was had by all. When is game 8? Absolutely positively do not want to miss it.

Serge: All picks are trades, handle them anyway you want. NNVC is different. It is a buy and hold tightly.

Wings defense has been a problem all year. way down the list in pk's. It reared its ugly head again last night. Wings looked tired and hoessa played the whole series like a scared rabbit. Time to clean out the dead wood. Chelios, Maltby, Stewart,etc.

The Red Wings top 2 defensemen played the Pens with these injuries:

Nicklas Lidstrom: He was speared in the testicles by Patrick Sharp during Game 3 against Chicago and underwent surgery on the area two days later. he Missed Games 4 and 5 against Chicago, then returned and played every game of the Cup finals.

• Rafalski: He ruptured a disk in his back between the first and second round but returned for Game 6 against Anaheim. “It got to the point where he could play again,” Holland said, “but if had been the regular season, he would have been out another week or two. He played through the pain of a herniated disk.”

It's amazing they got as close as they did with these guys hurting like that.

NNVC is a "buy and hold tightly."

Why is Theracour Pharma, the company which developed and licensed the nanotechnologies, selling shares of NNVC like mad?

To raise money to build their own production facility. It's all there on the web site and in the SEC filings for anyone who can read.

How about Those Wings!

I mean Dominos Hot wings. Not Detroit.

Sorry for any confusion

Tom Everett Scott

Weekly Market Analysis From Charts and Coffee Blog is up - http://chartsandcoffee.blogspot.com/2009/06/sunday-night-coffee-61409.html

Allan...what's the address on those Aliens? (you saved $5..) Gary

Archuletta Mesa on Jicarilla Apache Reservation land

If NNVC were going to "hit" it would have done so by now.

We are now looking at a low slow slide into bankruptcy.

Get out while you can. NNVC is a dead dog with fleas. There is no tangible evidence to the contrary just a long stream of hype.

OT: Some of the bullish of this market was built on the robust manufacturing data coming out from China.

However, as my other day job in the logistic industry, I can tell you that there is nothing or close to it being shipped out from the southern ports of China. I spoke with my agent in SHA two days ago, there are nothing coming out from those ports as well.

Are all the goods are being manufactured for local consumption? I doubt that...

The trend is your friend and it is up... trade away!

:p

This movie talks about the Bilderberg Group....you may be interested.

http://www.youtube.com/watch?v=eAaQNACwaLw

Any views on LTXC...

whats happening to CEP at 4.20

Allan,

Do you have any stop price on CEP?

thanks

From the write-up:

"But the daily chart does provide an important piece of the puzzle, a stop. Blue Wave will turn bearish on this chart at the level of $3.81."

Might want to reanalyse this.... 50% retracement, and seems to be hovering, and trending upwards.

Post a Comment