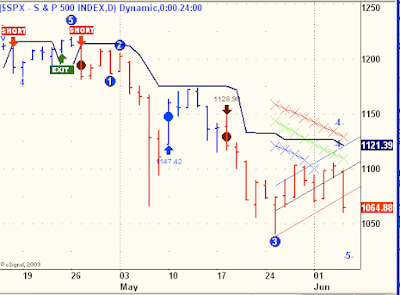

I sent out a Fibonacci 5 Alerts to my subscribers yesterday because the intraday trend model charts were all pointing hard down and finally getting in sync with the SPX Daily and Weekly Trend Models. Here is a portrait of the dominant down trend:

That Sell signal came on April 27 at about 1183 on the SPX. 120 points lower, it looks like the real deal. But you never know for sure, in other words, if it was easy, everyone would be doing it.

A Tradable Edge

Whoa, not so fast Lone Ranger. My experience tells me if it was easy, it would be dismissed by market players everywhere as too good to be true. The past few days I posted excerpts from my Trend Tables. Those weren't hand-picked examples of successful trades, those were 23 randomly chosen stocks, random insofar as I am lazy and those were easiest to crop off and excerpt, in all of their winning and losing ways. Those along with the above SPX chart consists of the heart and soul of my trend following trading models.

They are not the holy grail of trading, but they do constitute a tradable edge. I have maintained from the beginning, you can't always get what you want, but if you try sometimes you just might find you get what you need. That is what I tried to so tenaciously show off here over the course of the past five months. I know some of you get it because I've saved your testimonial emails and others are slowly getting it because I've saved all of your most basic questions and then light bulbs going off too. I learn from you just as I hope you are learning from me.

Maybe its too early to call this Trend Following Trading Models experiment a success, if you were like me, heavily short into yesterday's carnage, you are getting the idea of how a tradable edge works and how much stress, angst and anxiety such an approach is able to expunge and turn into hard core profits.

NNVC

As for NNVC, here is the last few sentences of my Weekend Update, just sent out to subscribers:

My only exception to this rule [Respect the Trends] has been NNVC and you all know how well that stubbornness has paid off.....NOT. Nonetheless, my reasons for buying and holding NNVC are as strong as ever and I have not sold a single share. One of these days, from a beach in Hawaii, I will point with pride at this strategy before passing out drunk in the surf. If you see me, please pull me back onto the sand. Thank you very much.

A

8 comments:

Allan, you never ever sold any shares of NNVC? Or are not NOW selling any shares?

I am starting to get it better,your model and charts, but the tables you send out,are hard for me to grasp for some reason,related to the format. Maybe its my fault but somehow, the format is "not organized enough", or not set up in a way that my brain processes data.

I look at the tables and all I see is a jumble of numbers and ticker symbls,the daily column and weekly column....its probably just me,but my brain cant get around it. I do much better when I look at a chart.

Like this one you posted here,its perfect. its exactly the same as my own chart looks.

Maybe I'll shoot you an email and we can explore whats wrong with my brain.(lol)

Now,with this chart....currently does look like wave 4 is becoming wave 5 Down. looks like target may be the 1020 area....which would be 'too perfect' since the top was 1220.

50 % retrace would take us back to 1120...where I and everyone else in the world will Bail Out and Go Short.(maybe even starting at 1100 . Lets see,to be more clear. If 1020 is the bottom ,completing 5 waves,for a total of 200 points,top to bottom.... that gives us a

38 % retrace to 1096

50% retrace to 1120

62% retrace to 1144

rallying back to that area creates a head and shoulders formation establishing the right shoulder in the 1130 to 1170 area and a time zone of mid July.

If this happens like this,heading into late july ,the astrological forecast hits with the foreboding negative aspect financial astrologers are watching for....T-Square of Saturn,Pluto,and Jupiter/Uranus .Notice all the geo-political tensions building up now and heading toward this time frame.

It would be very foreboding.

Re: NNVC

I haven't sold any NNVC this year and I'd have to check my records to see if I sold any last year, but I doubt it as I was a buyer for most of last year.

Allan, I am going to buy 500 shares of NNVC every Friday for the next 20 weeks, which will come to 10,000 shares, I am going to wait until Christmas 2014 to cash it ll in, it should be 100 bucks a share by then ...

I think that would be a careless way to buy NNVc or any stock. I suspect you are being sarcastic.

but for the 14 % chance that you are being sincere,

my thought about the stupidity of such a plan is just basic ignoring of the understanding of market movement,elliott wave,fibonnacci, S/R points,pivot points,trendlines,fundamental news, etc etc.... simply buying every friday like that,aside from the commission transaction charge of 200 transactions at lets say 8 bucks a pop will cost you 1600 dollars in fees....stupid right there...my conclusion :

You were being sarcastic.

go buy your Home Depot, and leave us alone.

If he buys 500 shares a week for 20 weeks, that's 20 transactions (not 200) please do your math before calling someone stupid.

20 transactions not 200. might be great cost averaging in if finances require just an approach.

Anyone interested in these kinds of sophisticated options strategies, here is a link to Phil's option service along with a 25% discount:

http://philstockworld.com/membership/signup.php?affiliate_special_signup=1&coupon_or_referrer=ilene

Post a Comment