Saturday, December 22, 2012

Thursday, December 20, 2012

For Clare

RIP

Time it was, and what a time it was, it was

A time of innocence, a time of confidences

Long ago, it must be, I have a photograph

Preserve your memories; They're all that's left you

Thursday, November 29, 2012

G.K. Chesterton

"All men are ordinary men; the extraordinary men are those who know it."

“There are no uninteresting things, only uninterested people.”

“To have a right to do a thing is not at all the same as to be right in doing it.”

“Drink because you are happy, but never because you are miserable.”

"The crowded stars seemed bent upon being understood."

“How you think when you lose determines how long it will be until you win.”

“You can only find truth with logic if you have already found truth without it.”

“I regard golf as an expensive way of playing marbles.”

“There are two ways of getting home; and one of them is to stay there.”

"America is the only nation in the world that is founded on a creed. That creed is set forth in the Declaration of Independence; perhaps the only piece of practical politics that is also great literature."

"Every one on this earth should believe, amid whatever madness or moral failure, that his life and temperament have some object on the earth. Every one on the earth should believe that he has something to give to the world which cannot otherwise be given."

"The way to love anything is to realize that it might be lost."

Saturday, November 24, 2012

Everybody's free.......

Do one thing every day that scares you.

Get to know your parents, you never know when they'll be gone.

Don't feel guilty if you don't know what to do with your life.

Get to know your parents, you never know when they'll be gone.

Don't feel guilty if you don't know what to do with your life.

Thursday, November 22, 2012

Wednesday, November 07, 2012

CTIX - 2013 Stock of the Year

The race to a $1 trillion market capitalization was all the rage amongst analysts as they clocked the growth rates of Google and Apple in recent months. That talk has cooled for the time being with the recent fall in value of both companies, but it does get one thinking about the possibilities and where better values might be for returns. The reality is that only the most elite companies could ever reach that valuation and making it there would only produce about a 70 percent return on Apple from its recent peaks. For Google, the returns would be in excess of 300 percent, but the stock price would need to climb from current levels of $670 a share to over $3,000 per share with its current structure.

Digging deeper shows that even a $100 billion market cap is quite rare in the grand picture with only about one-third of one percent of public companies trading in the U.S. markets achieving that mark. Reaching $10 billion is a daunting task, but far more realistic, with in excess of 500 companies cracking into that club and many more knocking at the door.

The best chance for success – and unparalleled ROI – is focusing on biotechnology companies. A look at a list of the biggest companies by market capitalization shows a myriad of biotech stocks. In fact, 6 of the top 50 companies (12 percent) in the U.S. by market cap are biotech, including 3 in the top 20 (15 percent). Of course, this excludes leading drug makers like Roche, Novartis and Merck because those $150-billion-market-cap companies are headquartered overseas, even though they trade on the U.S. markets.

Overall, there are about 20 U.S.-listed drug making companies that have broken above the $10 billion barrier for market capitalization with several others, such as Forest Laboratories (NYSE: FRX) that were recently sitting on the cusp.

Putting aside companies like Forest Labs, trying again to break back above $9 billion, there are other some smaller biotech’s, that have a strong chance to mushroom in value with their pipeline of products. In order to make prescient decisions in choosing a company, it is imperative to find the right field that can shoulder exponential growth. Pharmasset (formerly NASDAQ:VRUS) demonstrated the prowess of targeting an oral drug for Hepatitis C to compete with today’s standard of care, the injectable interferon, that can often times be poorly tolerated by patients. In mid-2007, shares of VRUS could be bought for $4 per share. As Pharmasset’s experimental drug, PSI-7977, moved through early stage and mid-stage clinical trials, shares rocketed to about $160 per share before a 2-for-1 forward split brought prices back down to $80 each. After another modest climb, Gilead acquired Pharmasset in November 2011 for $11 billion, or $137 per share…and the drug wasn’t even done with Phase II clinical trials. The ROI for shareholders in around $4 was a whopping 6,750 percent in four years. Incidentally, over the same period, Apple has produced a ROI of about 500 percent when it peaked about a month ago.

It’s this type of due diligence and foresight to hone-in on the most promising growth areas that has me looking at specific cancer areas of oncology for companies poised to experience Pharmasset-type of price movement. Why? Because cancer is still a leading global killer in dire need for new therapies – not simply reformulations of existing drugs – to destroy tumors. In order to meet the criteria, a company must be under $5 per share, have a unique product candidate that targets a large patient population to meet an area of unmet medical need and also have a strong pipeline that adds value through addressing additional indications. These characteristics will not only build share value on their own, but certainly grasp the attention of big biotechs for their starving pipelines.

There are several prospects that command attention, but limiting the list to companies already in clinical trials, the best candidate for a steady rise in share price potentially leading into an explosion is Beverly, Massachusetts-based Cellceutix Corporation (OTCBB: CTIX).

Cellceutix is young company that slips past many big board players, but offers one of the largest upsides of any traditional drugmaker because of the uniqueness of its flagship drug. The first doses in clinical trials of Kevetrin™, the company’s flagship anti-cancer compound, are now being administered at the vaunted Harvard University Dana-Farber Cancer Institute and partner Beth Israel Deaconess Medical Center. Kevetrin™ is no ordinary cancer drug. Its Mechanism of Action (MOA) acts upon the crucial tumor suppressing protein p53, referred to as “The Guardian and of the Human Genome” because its job as master regulator of the cell cycle. In nearly every cancer case, p53 is disrupted in its duty to induce apoptosis (programmed cell death) and shunt cancer cells from dividing uncontrollably.

The clinical trials at Dana-Farber and Beth Israel are evaluating Kevetrin™ against a wide array of solid tumors. Where many companies have to try and delineate a cancer line that their drug may prove a therapeutic benefit, Cellceutix is afforded the luxury of a basket of tumor strains because muted p53 activity is a culprit in nearly every type of cancer. That type of potential is unmatched by any peer.

Kevetrin™ has been extensively researched in the lab against many different cancer lines, including breast, lung, colon, leukemia, prostate and more, for which the company can boast the drug outstripped controls in slowing tumor growth and shrinking tumor sizes in each. The reason for the strong results stems from the MOA which shows Kevetrin™ helps p53 re-assume its normal function as a tumor destroyer. This opens the door for Kevetrin™ to become a front-line defense for any cancer diagnosis if the data is replicated in humans. As it stands, the stock seems undervalued at 95 cents, but when preliminary data starts to stream in from Dana-Farber and Beth Israel, the stock should see substantial, rapid appreciation in value.

Kevetrin™ is also readying to undergo additional studies being funded by Beth Israel in combination with Pfizer multikinase inhibitor drugs as potential new therapies for renal cancer and melanoma. Moreover, Cellceutix announced that a major university in Europe has approached them to sponsor and host additional research on Kevetrin targeting leukemia in combination with drugs from one of the world’s biggest pharmaceutical companies. That protocol for clinical trials is being written currently, according to Cellceutix. Trials could commence as soon as the first quarter of 2013.

Two major pharmas? Some of the world’s foremost cancer hospitals? Major players approaching Cellceutix and offering to pay to run clinical trials? These are very rare happenings and outwardly validate the potential for this small company’s new drug.

Adding to its pipeline in development, Cellceutix is having its anti-psoriasis drug, Prurisol, formulated by Dr. Reddy’s Laboratories (NYSE: RDY) for a Phase II clinical trial late Q1/early Q2 next year. Psoriasis trials are generally pretty brief (either the drug works or it doesn’t), so data from that clinical research could arrive by the start of the second half of 2012. Lab studies produced stellar results showing Prurisol eliminated virtually any trace of psoriatic tissue in animal models comparing Prurisol to methotrexate, a standard of care today. Prurisol making it to market is another multi-billion dollar proposition for Cellceutix.

Given the shallow pipelines of major pharmaceutical companies, Cellceutix is a premier early-stage acquisitions. They have a connection with Pfizer already and have relationships with other major pharma as evidenced through Non-Disclosure Agreements. Merger and acquisition activity in the biotechnology space is soaring in 2012 and analysts expect the pace to quicken as patent cliffs are sucking revenues from the world’s leading drug makers. Shareholders may not even want Cellceutix to be an acquisition target as the valuation is too low at this moment. As the company continues to develop its pipelines, the valuation should rise on its own and accommodate merger activity at much higher future prices.

When it comes to sheer, raw upside potential, Cellceutix is a standout and possesses the type of headroom for growth that will soon command investor and analyst attention. Others can chase Google and Apple, but the bigger plays are in biotech; you just have to know which one.

TAGS: Apple, Beth Israel, Google, ROI

Saturday, November 03, 2012

Does anyone know where the love of God goes?

Does any one know where the love of God goes

when the waves turn the minutes to hours?

The searchers all say they'd have made Whitefish Bay

if they'd put fifteen more miles behind 'er.

They might have split up or they might have capsized;

they may have broke deep and took water.

And all that remains is the faces and the names

of the wives and the sons and the daughters.

In a musty old hall in Detroit they prayed,

in the "Maritime Sailors' Cathedral."

The church bell chimed 'til it rang twenty-nine times

for each man on the Edmund Fitzgerald.

The legend lives on from the Chippewa on down

of the big lake they call "Gitche Gumee."

"Superior," they said, "never gives up her dead

when the gales of November come early!"

Sunday, October 28, 2012

Things Have Changed

People are crazy, times are strange

I'm locked in tight, I'm out of range

I used to care, but things have changed.

I'm locked in tight, I'm out of range

I used to care, but things have changed.

Sunday, October 21, 2012

GEORGE MCGOVERN DIES; LOST 1972 PRESIDENTIAL BID

George McGovern dies; would have saved 35,000 American lives, my friends, peers, classmates, my generation.....had he been elected President in 1972.

Sunday, October 14, 2012

Harvest Moon

October, the last wave goodbye of summer. Every memory I have begins here. Sweet comfort, warm jackets, hands-holding as we walk. Once ahead, is now behind. Always remembered, beneath the harvest moon.

Sunday, October 07, 2012

Wednesday, September 26, 2012

Andy Williams - RIP

As I watch icons of my youth pass, I am reminded not of events, or people, or my life from that time. Instead, feelings once real, then lost and forgotten, return as if they were inside of me all of these years. They are my friends. My best friends.

"Moon River" is a song composed by Johnny Mercer (lyrics) and Henry Mancini (music) in 1961, for whom it won that year's Academy Award for Best Original Song. It was originally sung in the movie "Breakfast at Tiffany's" by Audrey Hepburn, and has since been covered by many other artists. The song also won the 1962 Grammy Award for Record of the Year.

It became the theme song for Andy Williams, who first recorded it in 1961 and performed it at the Academy Awards ceremonies in 1962. Williams's version was disliked by Cadence Records president Archie Bleyer, who believed it had little or no appeal to teenagers. Andy Williams's version never charted, except as an LP track, which he recorded for Columbia in a hit album of 1962.

Williams said he never tired of singing "Moon River," whose melody he considered "beautiful" and whose lyrics he called "timeless."

Sunday, September 16, 2012

My iPhone; My Best Friend

My constant companion, it goes with me everywhere. I have just never had a friend like this, a confidant so loyal, so dependable, so caring and close.

It will sit on my lap as we drive around town. Sometimes I will let it hang out the window so it can feel in the wind on its screen. It loves that. But I must be careful because like all iPhones, it's always looking out for other iPhones, beeping and chiming and just lighting up every time they meet.

I remember when I flew out to South Carolina, they made me put it in a container to go through the x-ray at airport security. I told it just to be still, close its eyes and don't let out a peep. It came through intact, joyful and oh, so happy to be back in my pocket.

I used to take it on dates and it always seemed to know just when to get me off the hook at awkward moments. Yes, there is an App for that. It loved the beach, taking so many photos and so excited by the sunsets, it was just drained by the time we got home.

In the morning, it always knows just when to wake me for work and if I have to be away from my computer, it always keeps the time for me, updates the markets, watches out for severe weather and get this, will turn itself into a flash light when the lights go out, or if I need to put a key into a lock in the dark.

In the quiet moments of the night, it will play my favorite love songs, or tune me into a radio broadcast from around the world, making sure I know all that there is to know so I can me ready for anything, anywhere. It will take me shopping, finding me the best deals and the newest gadgets to make my life easier. In the woods, it shows me true North, making sure I am never lost. It shows me the way to anywhere I want to go and even will let me watch my beloved Detroit Red Wings' games, even when its just sitting there on my lap while I drive.

No matter how much it is watching out for me, it always has time for a game, either with just the two of us or with virtually anyone else in the world. It's always there, always looking out for me, always putting me first.

Oh how I wish my parents could have met it. They would so happy, so proud that I had found such a wonderful partner for my life.

A

It will sit on my lap as we drive around town. Sometimes I will let it hang out the window so it can feel in the wind on its screen. It loves that. But I must be careful because like all iPhones, it's always looking out for other iPhones, beeping and chiming and just lighting up every time they meet.

I remember when I flew out to South Carolina, they made me put it in a container to go through the x-ray at airport security. I told it just to be still, close its eyes and don't let out a peep. It came through intact, joyful and oh, so happy to be back in my pocket.

I used to take it on dates and it always seemed to know just when to get me off the hook at awkward moments. Yes, there is an App for that. It loved the beach, taking so many photos and so excited by the sunsets, it was just drained by the time we got home.

In the morning, it always knows just when to wake me for work and if I have to be away from my computer, it always keeps the time for me, updates the markets, watches out for severe weather and get this, will turn itself into a flash light when the lights go out, or if I need to put a key into a lock in the dark.

In the quiet moments of the night, it will play my favorite love songs, or tune me into a radio broadcast from around the world, making sure I know all that there is to know so I can me ready for anything, anywhere. It will take me shopping, finding me the best deals and the newest gadgets to make my life easier. In the woods, it shows me true North, making sure I am never lost. It shows me the way to anywhere I want to go and even will let me watch my beloved Detroit Red Wings' games, even when its just sitting there on my lap while I drive.

No matter how much it is watching out for me, it always has time for a game, either with just the two of us or with virtually anyone else in the world. It's always there, always looking out for me, always putting me first.

Oh how I wish my parents could have met it. They would so happy, so proud that I had found such a wonderful partner for my life.

A

Monday, September 03, 2012

So Poignant, So Sad

You can see it on his face, in his eyes;

You can hear it in his words,

Written so long ago;

You feel the sadness of a generation;

You mourn a President dead in Dallas;

The blood soaked years of Vietnam;

This unconscionable crime;

We share his pain;

The held-back tears;

We stand with him.

So poignant,

So sad.

You can hear it in his words,

Written so long ago;

You feel the sadness of a generation;

You mourn a President dead in Dallas;

The blood soaked years of Vietnam;

This unconscionable crime;

We share his pain;

The held-back tears;

We stand with him.

So poignant,

So sad.

Thursday, August 30, 2012

Skip The Light Fandango

I don't care.

Sounds reckless, irresponsible and oblivious to consequences.

On the contrary, it is the only way to get through the maze of life.

When you don't care about outcomes, you don't worry. When you don't worry, you don't stress. When you don't stress, you live a happier and longer life. You have confidence in yourself, your actions, your footprint.You stand tall, you smile, you are fun to be around and you appreciate, then devour all that life has to offer.

You skip the light fandango.

Sounds reckless, irresponsible and oblivious to consequences.

On the contrary, it is the only way to get through the maze of life.

When you don't care about outcomes, you don't worry. When you don't worry, you don't stress. When you don't stress, you live a happier and longer life. You have confidence in yourself, your actions, your footprint.You stand tall, you smile, you are fun to be around and you appreciate, then devour all that life has to offer.

You skip the light fandango.

Saturday, August 25, 2012

Baker Street

Remembering that I'll be dead soon is the most important tool I've ever encountered to help me make the big choices in life. Because almost everything — all external expectations, all pride, all fear of embarrassment or failure - these things just fall away in the face of death, leaving only what is truly important. Remembering that you are going to die is the best way I know to avoid the trap of thinking you have something to lose. You are already naked. There is no reason not to follow your heart.

-Steve Jobs

Sunday, August 19, 2012

L'art pour l'art

As a second year student at the University of Michigan, I took a course on cinematography taught by Professor George Manupelli. Rather than sit in a big lecture hall, Dr. Manupelli taught us film sitting is a cramped colorless classroom filled with 19 year-old aspiring filmmakers.

On the first night, (most of his classes were held at night), Dr. Manupelli sat on the edge of a desk and asked us why we were there. Eventually, someone got it right, we were there for art.

"Why art?"

What seemed like a thousand answers later (it was only 40 minutes), he told us:

"Art for art's sake."

On the first night, (most of his classes were held at night), Dr. Manupelli sat on the edge of a desk and asked us why we were there. Eventually, someone got it right, we were there for art.

"Why art?"

What seemed like a thousand answers later (it was only 40 minutes), he told us:

"Art for art's sake."

Saturday, August 04, 2012

These are the days

These are the days of the endless summerI looked for this video on YouTube, it found me instead.

These are the days, the time is now

There is no past, there's only future

There's only here, there's only now

A portrait of earth's wonder, of stillness by design.

It will touch your soul in breathtaking silence.

It will change your life, as it did mine.

These are the days of the endless dancing and thePlay this for someone,

Long walks on the summer night

These are the days of the true romancing

When I'm holding you oh, so tight

before it is too late.

Before being taken from each other

into another life.

These are the days now that we must savor

And we must enjoy as we can

These are the days that will last forever

You've got to hold them in your heart

Monday, July 30, 2012

High Hopes

Encumbered forever by desire and ambition

There's a hunger still unsatisfied

Our weary eyes still stray to the horizon

Though down this road we've been so many times

The grass was greener

The light was brighter

The taste was sweeter

The nights of wonder

With friends surrounded

The dawn mist glowing

The water flowing

The endless river

Forever and ever

Wednesday, July 04, 2012

Something

It's hard to imagine, think, grasp, that most of the people in this video are dead.

So many of us grew into adults with the Beatles at our side. They are remembered today by the raucous crowds and their silly interviews, for their pilgrimage to mysticism and drugs, for their break-up and solo careers.

Four kids from Great Britain, thrust center stage into the dissonance of a generation. We remember them for their music, for Ed Sullivan, for the tragedies that somehow sought them out, leaving only two still standing.

I downloaded $40 worth of their songs from iTunes. Along with the flashbacks of my youth, the music reminded me of how much we all wanted to find love, the love described in their songs, the sweet romantic love, the kind they each found in their lives, despite and not because of their fame.

I know this is not the best quality video of the Beatles. Or maybe it is, not in a technical sense, but in a romantic sense. They lived the dream. Not of fortune, nor of fame. They set a standard for love, deep, all encompassing, impassioned love. We owe it to ourselves to fight that good fight, to wherever, to whoever, it takes us. We owe it to ourselves and we owe it to them.

So many of us grew into adults with the Beatles at our side. They are remembered today by the raucous crowds and their silly interviews, for their pilgrimage to mysticism and drugs, for their break-up and solo careers.

Four kids from Great Britain, thrust center stage into the dissonance of a generation. We remember them for their music, for Ed Sullivan, for the tragedies that somehow sought them out, leaving only two still standing.

I downloaded $40 worth of their songs from iTunes. Along with the flashbacks of my youth, the music reminded me of how much we all wanted to find love, the love described in their songs, the sweet romantic love, the kind they each found in their lives, despite and not because of their fame.

I know this is not the best quality video of the Beatles. Or maybe it is, not in a technical sense, but in a romantic sense. They lived the dream. Not of fortune, nor of fame. They set a standard for love, deep, all encompassing, impassioned love. We owe it to ourselves to fight that good fight, to wherever, to whoever, it takes us. We owe it to ourselves and we owe it to them.

Friday, June 15, 2012

Dream of a Fallen Soldier

This is about a song from 1971.

I had just graduated from the University of Michigan. My girlfriend Claudia and I decided to take a summer road trip. We started in Ann Arbor where we drove first to Boston to visit Elliott and Cookie. The four of us then drove to Vermont in two different cars, one couple each. We camped out in the tranquil, spiritual Vermont woods for two nights. It was Cookie's first time with weed. Then Elliott and Cookie went back to Boston where Elliot started his first year of law school at Boston College. Claudia and I continued on our road trip, driving first to Montreal where we got on the TransCanada highway on our way across that beautiful country all the way to Vancouver.

We camped out mostly. I remember laying in the tent in Thunder Bay, Ontario, where we were kept up all night by the most severe thunderstorm of our lives. Across the vast flatlands of Manitoba and Saskatchewan to beautiful Alberta where we were mesmerized by the beauty of Banff and of Lake Louise. We were still camping, eating mostly brown rise and vegetables. We were kids in the first genuine love of our lives.

Then we hit the Canadian Rockies and stoned as we were, it was the most breathtakingly exquisite two-days drive-though of our lives. All the while, the music of our time provided the soundtrack, sometimes gentle and romantic, sometimes loud and rowdy, all out of the radio of the Chevrolet Vega. By the time we reached British Columbia, we realized Western Canada was one of the most pristine places on earth. Through the beautiful city of Vancouver, across the US border, south through Washington and down the Oregon coast to California, to Berkeley, where we stayed at a,"Hostel for Couples."

By then, we were hardly speaking to each other. Traveling together for six weeks like that, relationships either blossom or die. It was the latter for us. We turned back and drove all night to Salt Lake City were we checked into a motel about 8:00 am and stayed for a very uncomfortable 24 hours. Three days later we were back in Ann Arbor, road weary and broken, a couple-once-in-love.

Your Song, which meant so much to us in Vermont, became a cynical commentary on what was only the naiveté of two kids who knew nothing about love.

I saw Claudia only one more time. About six months later I drove back to Boston, stopping at her parents house in New Rochelle where she was staying to say good-bye one last time.

Forty years later, I listen to Elton John and remember that for one fleeting moment in my life, words seemed so real, so warm, so perfect. Forty years later, its just the dream of a fallen soldier.

I had just graduated from the University of Michigan. My girlfriend Claudia and I decided to take a summer road trip. We started in Ann Arbor where we drove first to Boston to visit Elliott and Cookie. The four of us then drove to Vermont in two different cars, one couple each. We camped out in the tranquil, spiritual Vermont woods for two nights. It was Cookie's first time with weed. Then Elliott and Cookie went back to Boston where Elliot started his first year of law school at Boston College. Claudia and I continued on our road trip, driving first to Montreal where we got on the TransCanada highway on our way across that beautiful country all the way to Vancouver.

We camped out mostly. I remember laying in the tent in Thunder Bay, Ontario, where we were kept up all night by the most severe thunderstorm of our lives. Across the vast flatlands of Manitoba and Saskatchewan to beautiful Alberta where we were mesmerized by the beauty of Banff and of Lake Louise. We were still camping, eating mostly brown rise and vegetables. We were kids in the first genuine love of our lives.

Then we hit the Canadian Rockies and stoned as we were, it was the most breathtakingly exquisite two-days drive-though of our lives. All the while, the music of our time provided the soundtrack, sometimes gentle and romantic, sometimes loud and rowdy, all out of the radio of the Chevrolet Vega. By the time we reached British Columbia, we realized Western Canada was one of the most pristine places on earth. Through the beautiful city of Vancouver, across the US border, south through Washington and down the Oregon coast to California, to Berkeley, where we stayed at a,"Hostel for Couples."

By then, we were hardly speaking to each other. Traveling together for six weeks like that, relationships either blossom or die. It was the latter for us. We turned back and drove all night to Salt Lake City were we checked into a motel about 8:00 am and stayed for a very uncomfortable 24 hours. Three days later we were back in Ann Arbor, road weary and broken, a couple-once-in-love.

Your Song, which meant so much to us in Vermont, became a cynical commentary on what was only the naiveté of two kids who knew nothing about love.

I saw Claudia only one more time. About six months later I drove back to Boston, stopping at her parents house in New Rochelle where she was staying to say good-bye one last time.

Forty years later, I listen to Elton John and remember that for one fleeting moment in my life, words seemed so real, so warm, so perfect. Forty years later, its just the dream of a fallen soldier.

Thursday, May 24, 2012

Where am I going?

The last day at the beach began with grace bestowed beneath an orange morning sky. The divine gifts of sunrise, of seabirds and of that calming cadence, the symphony that is the ocean. Two daughters and a father, a moment frozen in this snapshot of three lives.

In the Charleston drizzle we say our good-byes and soon my plane soars above the clouds. Around me strangers travel with their own tales and woes. I try not to think too much. Say yes to a Jack and ginger ale. Why have I left them behind once again? Where am I going and why am I going there? When the Jack comes, these questions will fall away unanswered and I will kick them beneath my seat.

"We Bought a Zoo," is shown hanging from a screen in the first class cabin. Matt Damon and his two children buy a zoo to move on, to ease the loss of his wife and their mother. The story is about living from your heart, not your head, letting go of the past and living your life in the present on your way to the future. At the end of the movie Damon takes his son and daughter to the spot where he first saw, first talked to their mother. He finds 20 seconds of courage and the words to fill them. "Why would such a beautiful woman like you want to talk to a person like me?" She looks up, sees his heart through his eyes and answers, "Why not?"

We didn't get to land in Phoenix, not as Delta planned. Wind shear swept under the nose of the plane just 200 feet from setting down on the Sky Harbor runway: Divert to Tucson. Safely in Tucson, strangers on the plane become intimate friends, together having flirted with, then avoiding disaster. We were in the hands of a talented crew well trained to save lives. We mingled while men in green overalls refueled the plane for the 90 mile jaunt back to Sky Harbor in Phoenix. This time we touched down, the cabin door opened and baggage was unloaded. Two hundred twenty stories scurried into the waiting embraces of friends, families and rental car shuttles. Not a seabird was seen among them.

I'm tired, my years dwindling, drifting away. Yet there was still joy to be made out of the moments when six foot-prints worked a path through the sand. From under my seat I had pulled out the one that asked, "Where are you going?" It's where I have always been going. A special place where someone cares that I have come home. Where she reaches out to touch me and remind herself that I am in her life, real, that she found me and will never let me go. That is where I am going. It is a journey that never seems to end.

In the Charleston drizzle we say our good-byes and soon my plane soars above the clouds. Around me strangers travel with their own tales and woes. I try not to think too much. Say yes to a Jack and ginger ale. Why have I left them behind once again? Where am I going and why am I going there? When the Jack comes, these questions will fall away unanswered and I will kick them beneath my seat.

"We Bought a Zoo," is shown hanging from a screen in the first class cabin. Matt Damon and his two children buy a zoo to move on, to ease the loss of his wife and their mother. The story is about living from your heart, not your head, letting go of the past and living your life in the present on your way to the future. At the end of the movie Damon takes his son and daughter to the spot where he first saw, first talked to their mother. He finds 20 seconds of courage and the words to fill them. "Why would such a beautiful woman like you want to talk to a person like me?" She looks up, sees his heart through his eyes and answers, "Why not?"

We didn't get to land in Phoenix, not as Delta planned. Wind shear swept under the nose of the plane just 200 feet from setting down on the Sky Harbor runway: Divert to Tucson. Safely in Tucson, strangers on the plane become intimate friends, together having flirted with, then avoiding disaster. We were in the hands of a talented crew well trained to save lives. We mingled while men in green overalls refueled the plane for the 90 mile jaunt back to Sky Harbor in Phoenix. This time we touched down, the cabin door opened and baggage was unloaded. Two hundred twenty stories scurried into the waiting embraces of friends, families and rental car shuttles. Not a seabird was seen among them.

I'm tired, my years dwindling, drifting away. Yet there was still joy to be made out of the moments when six foot-prints worked a path through the sand. From under my seat I had pulled out the one that asked, "Where are you going?" It's where I have always been going. A special place where someone cares that I have come home. Where she reaches out to touch me and remind herself that I am in her life, real, that she found me and will never let me go. That is where I am going. It is a journey that never seems to end.

Go

And beat your crazy head against the sky

Try

And see beyond the houses and your eyes

It's ok to shoot the moon

So darling

My darling be home soon

Monday, May 07, 2012

Monday, April 30, 2012

Customer Service

Why is it that every time you call customer service for any product or service you are immediately solicited with a "brief" questionnaire about, "how we did?" I guess because no is bothering to answer these annoyance infringements on our time, they have changed tactics. Here is the newer, better, solicitation for our opinions of, "how we did?"

Dear Allan:

Thank you for contacting [name omitted because I don't want anyone to get hurt] Service and Support Department. Our records indicate that [let's just call him John Smith] was the primary representative who assisted you. Because providing excellent customer service is our prime objective, we would greatly appreciate it if you took a few moments to rate your experience with [XXX] and,in particular, John Smith.

Please click on the link shown below to complete the short list of questions. It's that easy, and, with only a few moments of your time, you'll be helping us provide the absolute best service possible. Please also note that John has a wife and two small children. Your refusal to participate in this survey will be interpreted as a failure of John to do his job and will result in his immediate dismissal from employment. His accounts will be frozen and his children removed from their home, becoming wards of the state. In addition, his wife Marie will be shipped to a Chinese shoe factory and John will be forced to move back in with his elderly parents, one of whom, your choice, will be shot.

Thank you for your time and assistance in this matter.

Dear Allan:

Thank you for contacting [name omitted because I don't want anyone to get hurt] Service and Support Department. Our records indicate that [let's just call him John Smith] was the primary representative who assisted you. Because providing excellent customer service is our prime objective, we would greatly appreciate it if you took a few moments to rate your experience with [XXX] and,in particular, John Smith.

Please click on the link shown below to complete the short list of questions. It's that easy, and, with only a few moments of your time, you'll be helping us provide the absolute best service possible. Please also note that John has a wife and two small children. Your refusal to participate in this survey will be interpreted as a failure of John to do his job and will result in his immediate dismissal from employment. His accounts will be frozen and his children removed from their home, becoming wards of the state. In addition, his wife Marie will be shipped to a Chinese shoe factory and John will be forced to move back in with his elderly parents, one of whom, your choice, will be shot.

Thank you for your time and assistance in this matter.

Wednesday, April 11, 2012

Lord Stanley's Cup

Wednesday starts the annual quest for the holy grail of ice hockey: The Stanley Cup. For those of us who care, this is our time of the year. Last team standing takes home the Cup:

The first Cup was won by the Montreal Hockey Club in 1893. My team, the Detroit Red Wings, have won the Cup 11 times, more than any other United States' based franchise. This year the Red Wings' players come from across the globe, including, Canada, Sweden, Russia, Finland, United States and Syracuse. Professional Ice Hockey has become a United Nations of boys on skates.

This is a special time of year in the hockey world. While mainstream media is filled with the banal and mundane, basketball and baseball, real men and women, those who know the difference between playing a game for money or playing a game for love, will be absorbed in two months of spiritual bliss: The Stanley Cup Playoffs.

Amen.

Originally inscribed the Dominion Hockey Challenge Cup, the trophy was donated in 1892 by then-Governor General of Canada the Lord Stanley of Preston, as an award for Canada's top-ranking amateur ice hockey club.

The first Cup was won by the Montreal Hockey Club in 1893. My team, the Detroit Red Wings, have won the Cup 11 times, more than any other United States' based franchise. This year the Red Wings' players come from across the globe, including, Canada, Sweden, Russia, Finland, United States and Syracuse. Professional Ice Hockey has become a United Nations of boys on skates.

The actual word hockey was mentioned.......in 1363, when King Edward III of England issued a declaration banning a list of games: "moreover we ordain that you prohibit under penalty of imprisonment all and sundry from such stone, wood and iron throwing; handball, football, or hockey; coursing and cock-fighting, or other such idle games."

This is a special time of year in the hockey world. While mainstream media is filled with the banal and mundane, basketball and baseball, real men and women, those who know the difference between playing a game for money or playing a game for love, will be absorbed in two months of spiritual bliss: The Stanley Cup Playoffs.

Amen.

Sunday, April 08, 2012

Sunday night, April 8, 2012

Shadows are fallin' and I've been here all day

It's too hot to sleep and time is runnin' away

Feel like my soul has turned into steel

I've still got the scars that the sun didn't heal

There's not even room enough to be anywhere

It's not dark yet but it's gettin' there.

Sunday, March 11, 2012

Happiness in 12 Minutes

From my long-time friend, David Gordon, a 12-minute video that resonates and inspires, or as David so eloquently writes, "Clever, witty, entertaining....and worth every moment of the 12 minutes to learn whart Shawn Achor has to share."

http://eutrapelia.blogspot.com/2012/03/12-minutes-to-happiness.html

http://eutrapelia.blogspot.com/2012/03/12-minutes-to-happiness.html

Tuesday, February 21, 2012

NVIV - Invivo Therapeutics

This is the kind of biotech that presents a compelling opportunity:

(1) Small market cap = $110M (about $2.15 per share);

(2) Product addresses market where there is no other functional treatments: Spinal Cord Injuries (SCI);

(3) Product has been tested on animals and it works:

(5) Outstanding Management

(6) Take-out candidate:

(7) Trend = LONG

(1) Small market cap = $110M (about $2.15 per share);

(2) Product addresses market where there is no other functional treatments: Spinal Cord Injuries (SCI);

"Currently, there are no treatment options for SCI patients to successfully restore function following a spinal cord injury. Existing treatments consist of a collection of approaches that only focus on symptoms of SCI, such as decompression and mechanical stabilization of the spinal cord, rather than on the underlying pathology."

Company Web Site

(3) Product has been tested on animals and it works:

"InVivo has demonstrated the proof of concept for its SCI therapy in primate and rodent animal models. The company is the first in history to successfully demonstrate functional improvement in a paralyzed non-human primate and believes this model is the best surrogate for how the products will work in humans."

Company Web Site(4) Huge market for product:

"The financial impact of spinal cord injury (SCI) is staggering, estimated to be between $244,000 and $829,000 in the first year alone and over a lifetime this could add up to between $1- $4 million. The annual global market for SCI is estimated at $10 billion. There are currently no successful treatment options for SCI patients"

- Tom Bishop, BI Research

(5) Outstanding Management

Frank Reynolds, CEO

"Mr. Reynolds is a co-inventor on four of InVivo’s patents and he is co-author and winner of the “2011 David F. Apple Award” given by the American Spinal Injury Association to the top published paper in the world for SCI research. He is the former Director of Global Business Development at Siemens Corporation where he had global responsibility for business development."

Bob Langer:

"Robert S. Langer is the David H. Koch Institute Professor at the Massachusetts Institute of Technology (MIT) (being an Institute Professor is the highest honor that can be awarded to a faculty member). Dr. Langer has written over 1,100 articles. He also has approximately 760 issued and pending patents worldwide. Dr. Langer’s patents have been licensed or sublicensed to over 220 pharmaceutical, chemical, biotechnology and medical device companies.

"He served as a member of the United States Food and Drug Administration’s SCIENCE Board, the FDA’s highest advisory board, from 1995 — 2002 and as its Chairman from 1999- 2002."

Company Web Site

(6) Take-out candidate:

"Starting with our DCF model, we’ve increased sales by 20% to account for “overwhelming” promotion of a massive sales force like J&J (JNJ) or Medtronic (MDT). We’ve also removed future dilution and lowered the discount rate to account for a much lower cost of capital. Finally, we’ve reduce the S&GA expense figuring that a larger company will use representatives already in the field promoting products for spinal surgery, biomaterials, tissue engineering, or neurology. We arrive at a “take-out” value of $525 million, or $7.25 per share. We believe this is a price that a company like J&J or Medtronic could easily pay and still see accretion."- Zacks

(7) Trend = LONG

Sunday, February 19, 2012

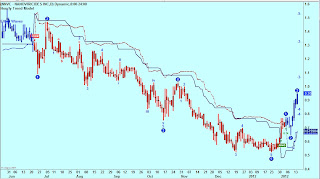

Just Charts

NASDAQ Monthly

VALUE LINE Monthly

SLV Weekly

GLD Daily

AAPL Weekly

NVIV Daily - InVivo Therapeutics

"We are initiating coverage an establishing a near-term target of $4.50 per share based on DCF (rounding up slightly from the DCF). However, with the financing risk out of the way, perhaps later this year, and clear momentum on the clinical front, we think InVivo can trade as high as $7 per share on speculation of a take-out."

VALUE LINE Monthly

SLV Weekly

GLD Daily

AAPL Weekly

NVIV Daily - InVivo Therapeutics

"We are initiating coverage an establishing a near-term target of $4.50 per share based on DCF (rounding up slightly from the DCF). However, with the financing risk out of the way, perhaps later this year, and clear momentum on the clinical front, we think InVivo can trade as high as $7 per share on speculation of a take-out."

- Zacks Investment Research

Thursday, February 16, 2012

NNVC - Update

Below is the NNVC 240 minute chart. The Elliott Wave pattern is very clean and the target for this move is $1.55. The potential for a Wave 4 retracement is to $0.80 and the NNVC Trend Model reverses short at $0.74. Thus the risk is about $0.20 for gain that projects to $1.55:

I don't like to trade out of NNVC because of news-factor. This is the kind of stock and company where a press release can come any day that would result in an overnight doubling of market cap. Still, if you are a believer in technical analysis, this is ample reason to be long the stock in here.

But there is more. Double the time frame to 480 minutes and you get the following chart:

It is very unusual for me to get the exact same wave count and the exact same price target when I double the time frame. This is impressive.

But there is more. Take a look at the 720 minute chart:

In all the years I have been doing this, I have never seen such consistency in EW structure and Fibonacci price targets when I increase the time frame three fold. That means, since it has never happened before, I don't really have a perspective on what it means. But my guess is that $1.55 is a solid a target and thus the risk:reward equation is a whole lot better then the simple 3:1 the first chart suggests.

My take on the fundamentals is written over on the right. It was written a long time ago. Nothing has changed. I own this stock....you bet I do.

I don't like to trade out of NNVC because of news-factor. This is the kind of stock and company where a press release can come any day that would result in an overnight doubling of market cap. Still, if you are a believer in technical analysis, this is ample reason to be long the stock in here.

But there is more. Double the time frame to 480 minutes and you get the following chart:

It is very unusual for me to get the exact same wave count and the exact same price target when I double the time frame. This is impressive.

But there is more. Take a look at the 720 minute chart:

In all the years I have been doing this, I have never seen such consistency in EW structure and Fibonacci price targets when I increase the time frame three fold. That means, since it has never happened before, I don't really have a perspective on what it means. But my guess is that $1.55 is a solid a target and thus the risk:reward equation is a whole lot better then the simple 3:1 the first chart suggests.

My take on the fundamentals is written over on the right. It was written a long time ago. Nothing has changed. I own this stock....you bet I do.

Wednesday, February 15, 2012

Allan's Market Commentary

For those readers of AllAllan who are not subscribers to AllanTrends, below is my Market Close Update that was sent out today, February 15, 2012 after the close of trading. I'm posting it to illustrate the kind of content that is part of the subscription service as well as to give all the best trade of the year, which is not NNVC (although it might be) but is a call on a substantial increase in volatility, either just around the corner, or, it may have already begun.

New Daily Signals

X------->Short

Allan’s Market Commentary

The recent reversals LONG by the VXX Trading Models are all profitable, but it hasn’t been without a fight. There are a number of fundamental factors that have me once again on the edge of my seat, so I am comfortable holding VXX, TVIX and/or VXX calls, all LONG. Though my confidence in these positions is mechanical, objective and disciplined by the very nature and tenants of trend following, the fundamental backdrop is subjective, scarier and emotional.

(1) The Mideast. The rhetoric here is reminiscent of the times before major conflicts have erupted in the past, except now all sides possess weapons of mass destruction. This rhetoric might be subterfuge for a secret understanding among the parties to limit the animosities to inflammatory accusations, but if so, it is a dangerous game to be playing with irrational geopolitical forces. If there is no such tacit understanding, it is just a matter of time before all hell breaks loose.

(2) European Private Sector. One bank over there goes under and the global financial network begins playing dominos, or worse yet, “last bank/government/continent left standing.” It will begin while we in North America are asleep. The ensuing trend in our equity markets will be a whopper. We will make a fortune, at least on paper, as withdrawing from our accounts may become problematic.

(3) Black Swan Event. The above two situations are so ominous that there is a chance of some Black Swan event coming out of nowhere that triggers all of the above.

In light of precariousness of everything right now, I don’t see how you can’t have some hedge against the worst case basis: A six-month call on VXX at a minimum. As Nike promotes, “Just Do It.”

VXX Hourly

NNVC

TREND TABLE

[omitted, subscribers only]

Feb 15, 2012

TAGS: Black Swan, Market Close, New Daily Signals, VXX

Tuesday, February 14, 2012

History

DETROIT -- The Detroit Red Wings have done something that no other NHL team had done before.

By defeating the Dallas Stars 3-1 on Tuesday night at Joe Louis Arena, they became the first team in League history to win 21 straight games on home ice – and by the looks of things, they might keep winning here for a while.

So reads the lead story tonight from nhl.com.

I watched the game in its entirety, wearing my official NHL Pavel Datsyuk jersey. I toasted my boys with a beer and talked to them throughout the game through my Sony HD television. I smiled and cheered and paced. I warned them against taking stupid penalties and urged them to clear the puck, go to the net, get back on defense and shoot, shoot, shoot.

At the end of the game, Bud Lynch, the 90-something announcer for the Red Wings, a man I used to stay up at night and listen to call the play-by-play as far back as 1960 (maybe even the late 50's, I can't remember), called out the names of tonight three stars:

3rd Star: Darren Helm

2nd Star: Henrik Zetterberg

First Star:

Valentines Day, Part II

CNBC Update:

Instead of CNBC, I am watching The Don Patrick Show (Fox Sports) where today, Don Patrick is interviewing two Sports Illustrated Swimsuit Models.

"I don't recognize you with clothes on," says Patrick.

The girls giggle.

One is from Connecticut, the other from South Africa. They both played sports. Patrick pulls out the swimsuit issue.

"Why is your top off? he asks Connecticut.

"I was hot," she answers.

A photo of South Africa fills the screen. She is almost naked and holding the leash of a cougar, or tiger, or something with four legs. I never did get a good look at it.

Connecticut is married. South Africa is looking for a boyfriend.

Cramer is recommending stocks on CNBC....I guess.

"We're normal," says one of them to a question that I missed.

"Have you ever been with a sportscaster?" asks Patrick, "Say one who has handed out the Super Bowl trophy?"

VXX just misses going LONG, or more accurately, I wasn't paying attention to VXX.

Their smiles fill the screen, they are beautiful barbie dolls with sweet personalities, young, happy, giftedspecimens women. Good luck and take care.

Happy Valentines Day......finally.

A

Instead of CNBC, I am watching The Don Patrick Show (Fox Sports) where today, Don Patrick is interviewing two Sports Illustrated Swimsuit Models.

"I don't recognize you with clothes on," says Patrick.

The girls giggle.

One is from Connecticut, the other from South Africa. They both played sports. Patrick pulls out the swimsuit issue.

"Why is your top off? he asks Connecticut.

"I was hot," she answers.

A photo of South Africa fills the screen. She is almost naked and holding the leash of a cougar, or tiger, or something with four legs. I never did get a good look at it.

Connecticut is married. South Africa is looking for a boyfriend.

Cramer is recommending stocks on CNBC....I guess.

"We're normal," says one of them to a question that I missed.

"Have you ever been with a sportscaster?" asks Patrick, "Say one who has handed out the Super Bowl trophy?"

VXX just misses going LONG, or more accurately, I wasn't paying attention to VXX.

Their smiles fill the screen, they are beautiful barbie dolls with sweet personalities, young, happy, gifted

Happy Valentines Day......finally.

A

Monday, February 13, 2012

Valentines Day - 2012

I grumbled about the holidays so I may as well touch upon Valentines Day while its nigh. What better describes this day, (1) the obnoxious commercialization epitomized by tractor-trailers full of roses in the parking lots of grocery stores, or (2) the asinine competition among grown-up men to see who can send the most flowers to fairest of them all?

Or, maybe its that days like this dangle in our memories and no amount of chocolate or flowers can fill the void where lovers once stood. Looking out into the evening, orange skies dance upon water that flickers into the horizon. Names and faces appear, come together, then fade. Years that live somewhere, now silent and alone.

I once had a girl, or should I say, she once had me.

A

Or, maybe its that days like this dangle in our memories and no amount of chocolate or flowers can fill the void where lovers once stood. Looking out into the evening, orange skies dance upon water that flickers into the horizon. Names and faces appear, come together, then fade. Years that live somewhere, now silent and alone.

I once had a girl, or should I say, she once had me.

A

Saturday, February 04, 2012

Aspen, Colorado

I've never been to Aspen, Colorado. But sometimes at night I lay in bed and think that in the morning, I'm moving to Aspen. What wonders might be awaiting me in this new, strange place? Who might be there, waiting her entire life for this stranger to show up out of no where, who on a whim decided he should move to Aspen, Colorado. They say it's cold there in the winter and almost perfect in the summer. That would fit well with the rest of my life, almost perfect.

How warm the fires would seem on those cold February nights. Snow falling quiet, white, pristine, while we stare into the the flame and tell each other the stories of our lives. When the time is right we retreat into the bedroom and snuggle closely under warm, wool blankets and wonder aloud how life could be any more splendid. Yes, I will move to Aspen in the morning.

How warm the fires would seem on those cold February nights. Snow falling quiet, white, pristine, while we stare into the the flame and tell each other the stories of our lives. When the time is right we retreat into the bedroom and snuggle closely under warm, wool blankets and wonder aloud how life could be any more splendid. Yes, I will move to Aspen in the morning.

The fire is dying

my lamp is growing dim

shades of night are lifting

morning light steals across my window pane

where webs of snow are drifting.

If I could only have you near

to breathe a sigh or two

I would be happy

just to hold the hands I love

on this winters night with you.

Thursday, January 26, 2012

On waking

It's spooky quiet, dark and cold at 4:30 in the morning. Now awake, there is nothing to do but think. Too early to get out from under the warm covers and too late to go back to sleep. Whatever dreams that were playing out are now forgotten and its clear I am back from those travels. Of all the fresh thoughts rushing by, one stands out: I have made it to another day of life.

There will come a morning when new days like this will not come. There will be no more. So while there is still time and life ahead, maybe its best to look at what still awaits. It may or may not end with a rainbow, but no matter what, it will end without regrets. That is my promise to myself.

There is a certain beauty to life, a magical journey through time. We share those moments with loved ones and each one of us looks back in longing affection at those simpler times. It's now 5:00am and the first light of a new day is streaming across the sky. Laying here alone, I love you.

There will come a morning when new days like this will not come. There will be no more. So while there is still time and life ahead, maybe its best to look at what still awaits. It may or may not end with a rainbow, but no matter what, it will end without regrets. That is my promise to myself.

Old man look at my life,Late September, 2002. I'm sitting on a wooden stairway that leads down to the beach at Kiawah. Off to the south, I can see the dimming edge of the sunset reflected off of the water. I don't remember why I was there or what thoughts were swirling around inside, but I do remember the sound of the surf against the sand and the smell of the ocean carried by the wind. A block away, my two young daughters sit doing homework, or by now, watching TV and a small white dog named Clare waits patiently, eagerly, lovingly, for my return. At that place and time, I didn't know this flawless moment would come back a decade later on a cold January morning in the desert. I didn't know the speed of life. I didn't understand timeless perfection.

Twenty four

And there's so much more

Live alone in a paradise

That makes me think of two.

Love lost, such a cost,

Give me things

That don't get lost.

Like a coin that won't get tossed

Rolling home to you.

There is a certain beauty to life, a magical journey through time. We share those moments with loved ones and each one of us looks back in longing affection at those simpler times. It's now 5:00am and the first light of a new day is streaming across the sky. Laying here alone, I love you.

Old man take a look at my life

I'm a lot like you

I need someone to love me

The whole day through

Ah, one look in my eyes

And you can tell that's true.

Old man look at my life,

I'm a lot like you were.

Old man look at my life,

I'm a lot like you were.

Monday, January 23, 2012

A rare sports blog

I didn't watch the game between the Ravens and the Patriots. It was the consolation game, the contest for the expansion league's "championship." But I did watch the real NFL championship game, the 49ers vs. the Giants. The game they call the Super Bowl is just a bunch of clever commercials, interspersed with a game between the AFC and NFL.

Note, I said "NFL" as there is and has always been just one professional football league. Buffalo. Cincinnati. Jacksonville. Who are they kidding? So this is what we got Sunday: San Francisco went deep into the 4th quarter without a converting a single 3rd down. The Giants made the playoffs with a 9-7 record, meaning in the regular season,they lost almost as many games as they won. In a virtual tie game for all of the 4th quarter and into overtime, neither offense could score. Only a fumble, make that two fumbles, on punt returns allowed the winning team to barely win the game.

Oh, the worst of it is now we have two weeks of New York and Boston coverage by the sports media. By the day of the contest, a game between an expansion league team and a mediocre 9-7 team will be heralded as the game of the century. Its all about selling commercial time and media hype. Its not football, its cheesy business. Hey, who was the college national champion? Had to think about it, didn't you?

That's enough bellyaching for me. The Wings and Blues are on in a few minutes. The St. Louis Blues, another expansion team. Will it never end?

Note, I said "NFL" as there is and has always been just one professional football league. Buffalo. Cincinnati. Jacksonville. Who are they kidding? So this is what we got Sunday: San Francisco went deep into the 4th quarter without a converting a single 3rd down. The Giants made the playoffs with a 9-7 record, meaning in the regular season,they lost almost as many games as they won. In a virtual tie game for all of the 4th quarter and into overtime, neither offense could score. Only a fumble, make that two fumbles, on punt returns allowed the winning team to barely win the game.

Oh, the worst of it is now we have two weeks of New York and Boston coverage by the sports media. By the day of the contest, a game between an expansion league team and a mediocre 9-7 team will be heralded as the game of the century. Its all about selling commercial time and media hype. Its not football, its cheesy business. Hey, who was the college national champion? Had to think about it, didn't you?

That's enough bellyaching for me. The Wings and Blues are on in a few minutes. The St. Louis Blues, another expansion team. Will it never end?

Wednesday, January 18, 2012

The Best Stock Advice In The World

At the beginning of the high tech bubble in 1997 you could have bought Apple Computer at $5.00 a share. It went to $37 at the high-tech peak in early 2000 then dropped back to $10 at the 2002 market bottom. By 2008 it was over $200. At the market lows of early 2009, back under $100. Three years later, as I write these words, Apple Computer is trading at $420 a share. Let's throw out the riff-raff, in 15 years AAPL went from $5 to $420.

I bring this to your attention to illustrate just how much wealth is available for the taking in the stock market. Real estate? You bought a house for $100K in 1985 and sold it for $500K in 2000. That's a 400% return in 15 years. Donald Trump is calling. When Apple rose from $5 to just $25 you had that same 400% return. Sorry, Donald, I can't come to the phone right now.

Knowing that there are opportunities to make money, big money, in stocks is a starting point. Few people understand the very basic tenant of investing. The illustration above of Apple is an outlier, an extreme example of good investment fortune. Or is it?

You can look at Apple as one huge 15 year long-trend. But, AAPL got cut in half in 2008-2009. Who has the grit to stay with a stock that has a 50% haircut in the midst of a scary bear market? Or asked another way, who can forecast the future direction of Apple or for that matter, any stock price?

Take another look at the chart above and note that there are red and blue bars. The red bars are when my trend algorithm said to get out of AAPL, it was going down. The blue bars represent those times when my trend algorithm said to hold AAPL LONG, it was in an uptrend. The algorithm wasn't perfect. It was late a bar or two every time the trend changed. But it did catch 95% of the movement of the stock, both up and down.

The best stock advice in the world is to buy stocks that go up and sell stocks that go down. It used to be a Will Rogers joke:

"Don't gamble; take all your savings and buy some good stock and hold it till it goes up, then sell it. If it don't go up, don't buy it."Rogers had the right idea, Harris has the right algorithm. Buy stocks that go up and sell stocks that go down. Listen to the math, its the best stock advice in the world.

Subscribe to:

Posts (Atom)