The investment seeks to replicate, net of expenses, 300% of the inverse daily performance of the MSCI Emerging Markets Index The fund will invest at least 80% of assets in securities that comprise the index. It will also utilize financial instruments that, in combination, provide leveraged and unleveraged exposure to the index. The fund is nondiversified.

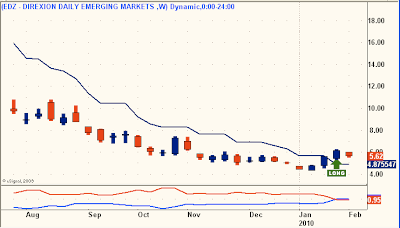

EDZ Weekly

Close-up EDZ Weekly

This was at $95 a year ago. It is a highly leveraged way to play a global financial crisis. The Weekly Trend Model just generated it's first Buy Signal since it's 2009 highs. I'm keeping an eye on the EDZ Daily Model for a turn up before jumping in.

7 comments:

im keeping eye too

where do u think is a good entry?

(For the NNVC naysayers)

Market down big today from the open...(as expected)

except for...NNVC

UP 3%

how funny

gosh...I'm sorry, I spoke too soon about NNVC

not up 3% ...its now up 5 %

gosh... I'm sorry,I spoke too soon again about NNVC

not up 5 % ....its now 7 1/2 %

oh,I'ma just having fun on a big down day thats all.

but it does look funny , the only stock I have thats in the green so far today.

I made big bucks in the most recent downtrend with EDZ. I made about 12% in 7 days. It really trended up fast when both China and the US were going down. Sort of a double-whammy with that ETF.

Bought EDZ last week on some signal - must have been a daily. I was trying to play only weekly's. Oh well - up 4% on it so far and thinking of buying more.

Long TZA,QID,SDS and short GOOG. That's a lot of short (for me). But, lovin' it today! Thanks Trend Models. What's next?!

mentioned days ago to check out UNG. It was about the ONLY green ticker today.

Nat Gas & UNG

it has been not performing according to NatGas due to regulartory pressure. But hard to imagine CFTC will impose more position limits in a deflationary context.

UNG also uses OTC swaps, not just futures. So, it is something to be traded, not treated as investment quality. Swaps are treacherous, but commodity ones probably less so than financial ones.

serenity for the market trader

For in the days before the flood, people were eating and drinking, marrying and giving in marriage, up to the day Noah entered the ark; ~ Mt 24:38

Post a Comment